Chase Sapphire Reserve or Preferred? How to Choose

The Chase Sapphire Reserve and the Sapphire Preferred have been the most important cards in the Chase Ultimate Rewards system. But, you can only choose one of them at a time. Recently, the Sapphire Preferred underwent some major changes that made the card more competitive compared to its bigger brother. Let’s break down these two cards to get better ideas on how to choose between one of them.

| Chase Sapphire Reserve | Chase Sapphire Preferred | |

|---|---|---|

| Annual Fee | $550 | $95 |

| Signup Bonus | 50,000 UR Points after spending $4000 in the first 3 months | 60,000 UR Points after spending $4000 in the first 3 months |

| Annual Travel Credit | $300 Travel Credit (no points rewarded using credit) | $50 Hotel Credit thru Chase Travel Portal (no points rewarded using credit) |

| Redemption Bonus | 50% bonus when redeemed on Chase Travel Portal & Pay Yourself Back | 25% bonus when redeemed on Chase Travel Portal & Pay Yourself Back |

| Travel spend multiplier | 3x | 2x |

| Dining spend multiplier | 3x; 10x Chase Dining | 3x |

| Online grocery spend multiplier | 1x | 3x |

| Chase Travel Portal spend multiplier | 10x on hotels & car rentals; 5x on flights | 5x excluding the qualified $50 Hotel Credit |

| Streaming services multiplier | 1x | 3x |

| Anniversary 10% points bonus on base spend | No | Yes |

| Lounge Access | Priority Pass Select & Chase Sapphire Lounges | No |

| Global Entry/TSA PreCheck/ NEXUS Credit | Yes; $100 every 4 years | No |

Choose Chase Sapphire Preferred if…

You’ve never had a Chase Sapphire card before

Chase Sapphire Preferred historically has the higher signup bonus except around the time of the Chase Sapphire Reserve’s debut. Since both cards have the same spending requirement of $4000 in the first 3 months after application, it’s best to pick the highest signup bonus offer first. The reason is that you can only get one Sapphire signup bonus every 48 months after receiving it before you’re eligible for another one. In recent times, the Chase Sapphire Preferred wins in the signup bonus department.

After the first anniversary year of the CSP, you may think of upgrading to the Sapphire Reserve if you wish to do so.

You already have a premium credit card

Many premium credit cards in the market give overlapping benefits like unlimited lounge access through Priority Pass and Global Entry credit that includes TSA PreCheck. Cards like the American Express Marriott Bonvoy Brilliant ($450 AF) and Capital One Venture X ($395 AF) provide those benefits. By combining one of the mentioned cards with the Chase Sapphire Preferred, you’re paying $545 or $490 annual fees respectively. Both setups boast less than the Sapphire Reserve’s annual fee of $550 before even discounting the cards’ benefits!

The catches are that you have more bank accounts and benefits to use to keep tabs on.

You’re confident in redeeming airline partners miles

In order to transfer Chase Ultimate Rewards points to airline and hotel partners, you’ll at least need the Chase Sapphire Preferred. If you’re set on transferring your Chase UR points to partner airlines or hotels, then the redemption bonus for the Chase Travel Portal is irrelevant until you decide to spend some of them there. With that said, it may not make sense to pay the extra premium of the Sapphire Reserve if you just want access to some of Chase UR partners that also overlap with other points system like the American Express Membership Rewards, Citi ThankYou, and Capital One Miles.

Choose Chase Sapphire Reserve if…

You’re not invested in a hotel loyalty program

The Chase Sapphire Reserve’s 10x multiplier on hotels through the Chase Travel Portal have the potential to be amazing to rack up a lot of Chase UR points depending on how much you travel and spend on hotel nights. By booking through the Travel Portal, you’re forgoing benefits that you would get from status of hotel loyalty programs. Then again, hotel loyalty programs aren’t for everyone, and it’s very rare to see at least a 15% cashback from many hotels worldwide thanks to the combination of 10x UR points spent thru the portal and the 50% bonus, in which avid Chase Travel Portal users can benefit from.

You want a simple system that offer premium benefits

Chase Sapphire Reserve offers a good balance between premium and simplicity. While it’s nice to redeem points for a business or first class airline ticket, it takes a lot of time, effort, and flexibility to do so to learn the intricacies of different airline programs and finding available award seats. CSR’s 50% bonus points when redeeming them through the Chase Travel Portal makes it more enticing for those looking into simplicity and getting many discounted travel expenses.

Don’t forget about the premium travel benefits like Priority Pass and Global Entry credit that come with the card. One niche benefit is the Priority Pass Restaurants that other Priority Pass from other issuers don’t have! CSR holders can eat for free on restaurants in certain airports.

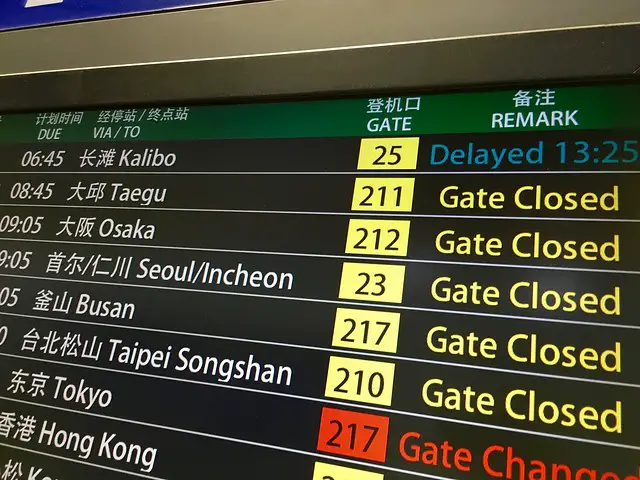

You want slightly better purchase & travel protections

Compared to the Chase Sapphire Preferred, the Sapphire Reserve has slightly better trip insurance, and even other premium credit cards from other issuers. However, the COVID pandemic makes it challenging to use travel insurance provided by credit cards, in which you’ll likely have to buy a separate insurance that covers COVID related issues with similar level of protection of the Sapphire Reserve’s protections. In normal circumstances, the extra $155 premium over the CSP may give you the extra peace of mind and tilt you over to the CSR instead.

Here are some key comparison of travel and purchase protections of both Sapphire cards (not full):

| Chase Sapphire Reserve | Chase Sapphire Preferred | |

|---|---|---|

| Trip Delay insurance | Up to $500 per ticket for delays of 6 or more hours | Up to $500 per ticket for delays of 12 or more hours |

| Rental car insurance | Primary | Primary excluding expensive and exotic cars |

| Purchase protection | Up to $10,000 per claim and up to $50,000 per year | Up to $500 per claim and up to $50,000 per year |

Conclusion- Chase Sapphire Reserve or Preferred?

The decision to choose either the Chase Sapphire Reserve or Preferred will depend on what cards you have in your credit card portfolio, complexity of your points redemption process, and travel habits. The Sapphire Preferred is excellent for those who are just looking to access Chase travel partners to transfer their flexible points to from different card issuers. This also means that you’re quite versed in the process of redeeming airline miles.

On the other hand, the Sapphire Reserve is still a decent choice for those looking for simplicity in booking process and card portfolio, but still wants premium travel benefits, including lounge access, Global Entry, and the slightly better travel and purchase protections.