Chase Sapphire Reserve or Capital One Venture X- Battle of the Blues

Both Chase Sapphire Reserve and Capital One Venture X are premium travel credit cards that offer similar benefits with some key differences. With the recent introduction of the Capital One Venture X (review), some people dubbed it the “Sapphire Killer”. Does the Chase Sapphire Reserve (review) still hold up against the new premium travel card in the business? Let’s find out!

Annual Fees

Let’s start with the basic surface level. As both credit cards are premium travel cards, you should expect hefty annual fees. The Chase Sapphire Reserve and Capital One Venture X boast $550 and $395 annual fee.

The Venture X wins when it comes to the annual fee cost, and the Sapphire Reserve needs other benefits that are at least worth $155 more to you to make up the difference.

Signup Bonus

Capital One Venture X offers a very lucrative signup bonus of 100,000 Capital One Miles, while the Chase Sapphire Reserve hasn’t really improved much with its 50,000 Chase Ultimate Rewards points bonus. The catch is that the Venture X requires you to spend $10,000 in the first 6 months, while the Chase Sapphire Reserve requires $4,000 in 3 months. If we strategize with how much to spend per month to hit the signup bonus, it’s $1,667 per month for the Venture X, and $1,334 per month for the Sapphire Reserve.

Because Chase only allows one Sapphire card signup bonus in every 48 months, it’s best to pick the highest offer first, which the CSR loses to frequently to its younger brother the Chase Sapphire Preferred.

Some people may not even be able to hit the signup bonus of the Venture X, and it’s not a good idea to apply for cards and miss its signup bonus. Do make sure you can comfortably hit the Venture X’s signup bonus requirement before applying. On the other hand, the Sapphire Reserve is at a more doable range of spending amount.

The Venture X wins when it comes to the signup bonus amount, but the Sapphire Reserve/Preferred wins in the ease of difficulty in hitting the signup bonus.

Earning Rates

Both cards are decent everyday spend earners with some powerful travel portal multipliers. Here’s a chart to visualize the differences:

| Chase Sapphire Reserve | Capital One Venture X | |

|---|---|---|

| Travel Portal (Hotels & Car Rentals) | 10x | 10x |

| Travel Portal (Flights) | 5x | 5x |

| Dining & General Travel | 3x | 2x |

| Chase Dining | 10x | 2x |

| Everything else | 1x | 2x |

The Chase Sapphire Reserve has a slight edge when it comes to spending multiplier, but because of its higher annual fee and just a mere 1x difference than the Venture X’s simple 2x back on dining and travel outside of portal, you’d have to spend a lot of money on those categories to come up ahead of the Venture X. Also, while Chase Dining offers a nice multiplier of 10x, it’s a very niche service that a lot of people cannot take advantage of. CSR also has promotional multipliers that last until March 2022 like Peloton and Lyft. I decide to ignore those as they’re temporary benefits and would make for fairer comparison.

Capital One Venture X wins in the earning category because it’s hard to come up ahead with mere additional 1x on dining and general travel while taking account of its higher annual fee. You’d need to spend a lot of money on those categories to come out ahead, which many people would find not feasible.

Travel Benefits

Both cards offer similar travel benefits with slight differences in execution. Here’s a table to visualize:

| Chase Sapphire Reserve | Capital One Venture X | |

|---|---|---|

| Travel Credit | $300 on Travel Portal & Outside of Travel Portal | $300 on Travel Portal Only |

| Global Entry Credit | $100 in every 4 years, with option to choose NEXUS instead for US-Canada border | $100 in every 4 years, no NEXUS option |

| Airport Lounge Access | Priority Pass Select + Chase Sapphire Lounges | Priority Pass Select + Capital One Lounges |

| No Foreign Transaction Fee | Yes | Yes |

| Car Rental Status | None | Hertz President's Circle |

| Car Rental Insurance | Primary Coverage for up to $75,000 | Primary Coverage for up to $75,000 |

| Trip Delay | Up to $500 if flight is delayed more than 6 hours due to covered reasons | Up to $500 if flight is delayed more than 6 hours due to covered reasons |

| Lost Baggage | Up to $3000 ($2000 for New York residents) per covered trip | Up to $3000 ($2000 for New York residents) per covered trip |

| Trip Cancellation | Up to $2000 if trip is cancelled due to sickness or death of the insured or family members & default of airline | Up to $2000 if trip is cancelled due to sickness or death of the insured or family members & default of airline |

| Anniversary Miles | None | 10,000 Miles |

Chase Sapphire Reserve has the better $300 travel credit because it’s not tied to the travel portal. It’s useful for those who participate in a hotel loyalty program where you’ll earn hotel points and elite nights towards higher status. Booking hotels through most travel portals, including ones from Chase and Capital One, will forgo hotel chain membership benefits.

The Venture X offers 10,000 Anniversary Miles whenever you agree to open the card for another year. This benefit kicks in after you pay the annual fee to keep the card open for another year.

Both cards offer standard premium travel card benefits like Global Entry credit and airport lounge access with Priority Pass Select. Both Chase and Capital One recently opened their own lounges at certain airports. However, the amount of airport lounges are still very limited, and I wouldn’t expect big expansions in the immediate future. A big positive to the Venture X is that authorized users that may be added for free have Priority Pass Select access!

When it comes to car rentals, the Venture X has the slight edge due to President’s Circle status with Hertz. But, its usefulness will solely depend whether or not you use car rentals to begin with.

Both cards are excellent to book your travels with thanks to the trip insurances like trip cancellation, lost baggage, primary car rental damage waiver, and to spend your money abroad because they have no foreign transaction fees.

The travel benefits are mostly a tie. But, I will give a slight win to the Sapphire Reserve on the annual travel credit because it’s more flexible & doesn’t force you to use a travel portal. However, the Venture X’s anniversary miles is a great benefit as long as you’re willing to keep the card for another year and know how to redeem Capital One Miles effectively. This effectively means Capital One is paying you to keep the card as long as you use can fully use its $300 travel credit.

Redemption Methods

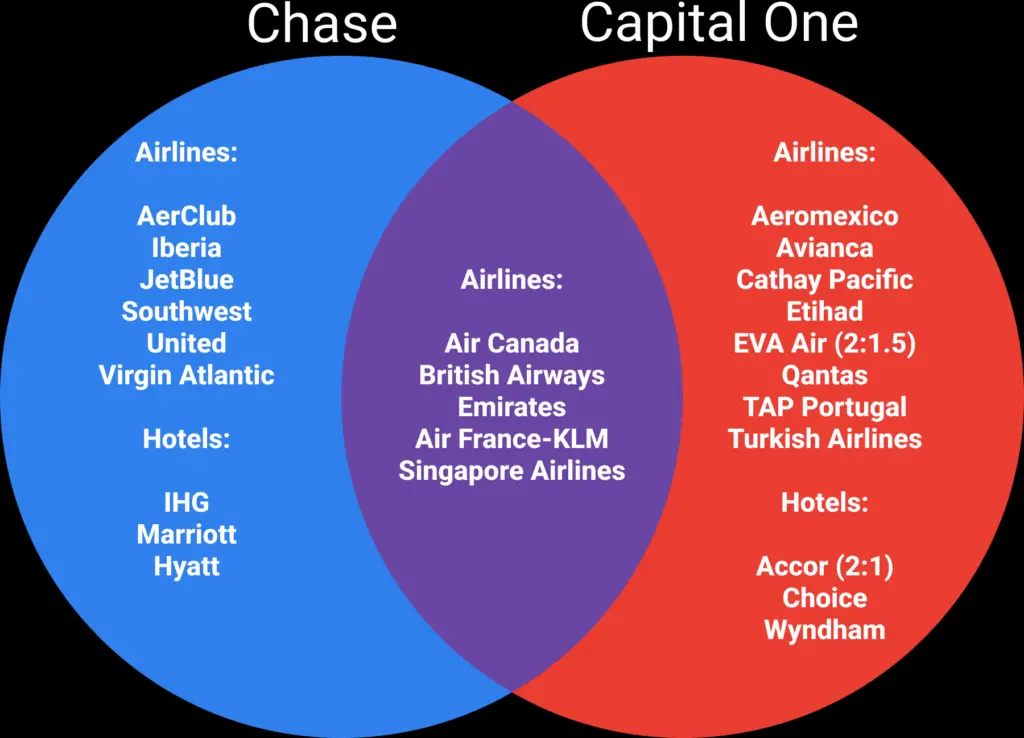

Chase Ultimate Rewards and Capital One Miles have different redemption methods and travel partners to transfer your points to.

| Chase Sapphire Reserve (cents per point) | Capital One Venture X (cents per point) |

|

|---|---|---|

| Statement Credit/Cash | 1 | 0.5 |

| Travel through travel portal | 1.5 | 1 |

| Airline Transfer Partners | 2+ | 2+ |

| Hotel Transfer Partners | ~1.7 | ~1.1 |

A positive to the Sapphire Reserve is the 50% bonus when redeeming UR points through the travel portal that the Venture X does not have. While you can extract more value by transferring to transfer partners, they take time and work to learn about the nuances of different loyalty programs and airline alliances. You also need a little bit of luck to find award availability if you can’t afford to be flexible with your travel plans. Capital One Miles also has poor redemption value for statement credit, so it will take more effort to get the best value out of Capital One Miles, similar to American Express Membership Rewards.

Depending on where you like or want to travel to, both programs share some of the more useful airline programs like Air Canada Aeroplan for Star Alliance award tickets that you can take advantage of for some points arbitrage purposes! Emirates and Singapore Airlines programs offer some of the most aspirational First Class products if you really want to try those out!

**UPDATE**: As of March 1, 2022, Capital One will add Virgin Atlantic as a partner, which is also a Chase partner! One good way to use Virgin Atlantic Miles is to book ANA First Class!

For hotels, Chase has better options for luxury with Hyatt and Marriott. But, Hyatt is the only hotel program worth transferring points to because of the unfavorable transfer ratio on IHG and Marriott.

Capital One’s best hotel partner is most likely to be Accor as 1 Accor point is worth ~1.1 cents per point. Even though the transfer ratio looks unfavorable, it’s good enough to surpass the 1 cpp mark, which most hotel points are struggling to achieve. Choice and Wyndham target toward budget-friendly hotel options with very limited aspirational property portfolios, which may not be worth transferring points to even if you find some good deals.

The winner is dependent on your level of comfort on redeeming your points for max value. Chase Sapphire Reserve fits for those who want simpler method that won’t require them to learn about airline and hotel programs, while the Venture X will take work to prevent the card from being a “fancy cashback” card.

Capital One Venture X + Chase Sapphire Preferred

If you want to have access to both Chase and Capital One transfer partners, you can consider having both the Venture X and Sapphire Preferred. What’s amazing about this hybrid setup is that they both have less annual fees ($490) than the Sapphire Reserve ($550)! If you’re willing to have multiple cards, then this really puts the CSR in a tough spot in bringing outsized value. Don’t forget that the Sapphire Preferred has 25% bonus when redeeming points on the Chase travel portal.

Multi Card Setup

Sapphire Reserve and Venture X are important cards to have in their respective points ecosystem. Both ecosystems allow for combining points earned within the points-earning cards into one account to even get more mileage out of your points (no pun intended).

| Chase Ultimate Rewards Earning Cards | Capital One Miles Earning Cards | |

|---|---|---|

| Chase Sapphire Reserve | Capital One Venture X | |

| Chase Sapphire Preferred | Capital One Venture | |

| Chase Freedom Flex | Capital One Venture One | |

| Chase Freedom Unlimited | Capital One Savor | |

| Chase Ink Cash (Business) | Capital One Savor One | |

| Chase Ink Unlimited (Business) | Capital One QuickSilver | |

| Chase Ink Preferred (Business) | Capital One Spark Miles (Business) | |

| Chase Ink Premier (Business) | Capital One Spark Miles Select (Business) |

There are plenty of choices to be had in either points ecosystem. But, Capital One appears to only allow up to two personal cards opened in under one account. Chase does not enforce card limits, but you are subject to the Chase 5/24 rule where Chase will automatically deny you for the affected Chase credit cards if you’ve opened 5 or more personal cards in a 24 month period.

Applying and getting approved for Capital One business credit cards Spark Miles & Spark Miles Select, may trigger the amount of personal cards opened, which presents a problem with the Chase 5/24 rule.

Capital One does have an edge against Chase in grocery category with their Savor One card, a category that Chase has been lacking with the exception of Chase Freedom Flex’s occasional quarterly bonus.

Chase clearly wins when it comes to multi-card setup due to no enforced limitations on personal cards despite its strict application rules. This results in much easier opportunities for signup bonuses and maximizing the points you earn on spend. Capital One does bring a simple, but good setup if you want a minimized card portfolio.

Conclusion

I believe Capital One Venture X has mostly been the winner against the Chase Sapphire Reserve. Its lower annual fee helps lessen the “sticker shock” effect of the Chase Sapphire Reserve. It seems that the CSR is targeted for those who’d redeem points on Chase Travel Portal for the 50% bonus redemption. But, that may not even justify its higher annual fee.

For those who are more serious about points & miles, a hybrid approach of the Capital One Venture X and Chase Sapphire Preferred will get you the best of both worlds at an even lower cost than the Chase Sapphire Reserve!

It appears that Chase should acknowledge their current competition and I sincerely hope that they will revamp the Sapphire Reserve to justify its higher annual fee and even bring some more exciting permanent benefits!